Quick Loans are so-called quick loans, whose popularity is growing every year. More and more people who can not count on receiving a bank loan decide to borrow money in the so-called parabank. Fast Loans have many advantages, which make them popular. However, remember that you should be …

Read More »Monthly Archives: March 2021

Financing installment loan calculator.

The calculator, interest calculation, monthly installment, amortization calculator, repayment calculation with this calculator for car finance, you can better estimate a possible same day loan. We help you with financing, which gives you additional financial flexibility at all times. Use the installment calculator to select a purchase amount and …

Read More »Clearly 10% more expensive than quick loans.

When a product is purchased through an e-store, this is extremely often done today with a payment solution from a major credit company, for example Caryl. When payment options are chosen, you can choose to pay everything at once or pay part over a certain period. With a low …

Read More »Linear Alpha Olefins Market Dimension 2021-27 Idemitsu Kosan, Linde, INEOS – KSU

International Linear alpha olefins market 2021 serves the most recent enterprise insights and superior future developments, Linear Alpha Olefins dominant gamers, forecasting, learning and discussing market particulars, market measurement, analysis of the market. Linear Alpha Olefins market share that has supplied a exact understanding of the general Linear Alpha Olefins …

Read More »Where to get the money Ideas for getting money quickly

Each of us may find ourselves in a situation where unforeseen expenditure forces us to look for additional financing. Most often in such situations, we reach for our reserves accumulated on the deposit or savings account or we borrow a certain amount from family or friends. But what if …

Read More »Fast loan companies are forced to cease lending.

Must stop lending

The Consumer Agency published a press release yesterday stating that they have banned the fast-loan company Lite lender, which conducts loan operations under 4 different brands, to lend money to private individuals. At the same time, the company is warned of Advance Pay and is forced to pay USD 200,000 in penalties.

The reason for these measures is that the companies mentioned above do not do a sufficiently good credit check, which means that they cannot assess the repayment capacity of the borrower. For example, companies have not requested information on expenses and other loans, which means that a proper credit check cannot be done.

Lite lender announces on its website that they will appeal the order from the Consumer Agency and now a legal process is expected that could lead to the company ceasing lending to consumers.

According to the Consumer Agency, which exercises supervision for, among other things, If the case is appealed, it is up to the Administrative Court to decide when Lite lender will cease its lending.

It is the first time ever that the Consumer Agency has taken such a hard time against a fast-loan company with same day approval and therefore the event was noticed in Sweden’s largest media.

Important with proper credit check

In recent years, the authorities have made increasingly stringent demands on fast-mortgage companies with the aim of, among other things, regulate the market and raise the quality of companies that conduct this type of lending. This includes This means that the Consumer Agency has reviewed the credit review process at most fast-loan companies

Doing a proper credit check is necessary to make a good assessment of whether or not a borrower can repay his loan. As a borrower, one should be critical if a company does not do a proper credit check as the credit check is also for the benefit of the customer.

New law places higher demands

On July 1, 2014, the Act on Certain Business with Consumer Credit entered into force, which means that permission is now required from the Swedish Financial Supervisory Authority to conduct lending operations to private individuals. All lenders have until December to submit their application.

Thereafter, the Swedish Financial Supervisory Authority will conduct a thorough review and then make a decision on whether the companies meet the requirements or not. Previously, fast-mortgage companies only had to be registered with Finansinspektionen, but now the companies end up under the supervision, which in itself places higher demands on fast-bank companies.

– We look at this very positively because it will ultimately benefit consumers so that more people can really apply sound credit. In addition, the market will be decontaminated, which means that rogue players will no longer be able to offer lending. Maeldúin is one of the largest players in this market and we work hard to offer high quality and secure consumer loans.

When a company falls under the supervision of the Swedish Financial Supervisory Authority, it will in practice mean that the company becomes completely transparent to the authority. You are constantly forced to report on required information as well as to show how you work to prevent, for example, money laundering.

The authorities will henceforth be able to make a better assessment of whether a company can truly live up to the requirements to be a stable lender who can follow all laws, rules and guidelines.

The law benefits consumers and serious lenders

For the consumer this means only benefits. As a borrower, you can today end up in the hands of rogue companies. On the internet, you come across everything from companies that claim that our lenders but are really only loan intermediaries to companies that are lenders but can have hutless prices and poor conditions for the consumer.

– Unfortunately, not all customers read the general terms and conditions, and it is usually in the terms that one can read whether a company is serious or not. For this reason, we believe that a secure relationship between lenders and borrowers is very important. Be sure to do a proper check on the company you are borrowing money from. A good way is to contact the industry association for fast loans to see who the members are.

SKEF is also a quality body that places demands on its members. The Consumer Agency, whose members are supervised, meets with member companies once every six months. about how they think a proper credit check should go.

9 revolutionary DCU Alpha start-ups to look at

The businesses popping out of DCU Alpha have seen success within the current previous. Will these 9 science-technology start-ups discover the identical launching pad to succeed? DCU Alpha is a research-intensive innovation campus co-located with Dublin Metropolis College (DCU). The Glasnevin-based campus brings collectively science-technology firms in a cluster that …

Read More »A possibility for cleantech start-ups to innovate for a greener future.

Power use and manufacturing actions account for two-thirds of worldwide greenhouse fuel emissions, in line with KPMG report. The report additionally factors out that renewable energies have the best potential to sluggish the tempo of local weather change induced by the growing volumes of those emissions. Because the world turns …

Read More »The revolutionary EasierHike® Alpha 5-in-1 cervical pillow launched on the Indiegogo crowdfunding platform

Alpha Pillow, like EasierHike’s newest product, quickly to be formally launched on Indiegogo, illustrates the practicality of the EasierHike model idea. The product ensures vacationers a extra enjoyable journey within the first place. Due to this fact, it’s designed to be compact and lightweight sufficient to be transported. As well …

Read More »The weak monetary outlook seems to be slowing the motion of Taiwan Alpha Digital Co., Ltd. (GTSM: 6204)

With inventory down 20% up to now three months, Taiwan Alpha Digital (GTSM: 6204) is simple to miss. To determine if this pattern might proceed, we determined to have a look at its weak fundamentals as they form long-term market tendencies. On this article, we’ve got determined to give attention …

Read More »Is your third stimulus examine the correct amount? Be sure the IRS has despatched your full cost

Calculate how a lot of the $ 1,400 is owed to you, even you probably have already acquired your cash. Sarah Tew / CNET When you have acquired your third stimulus management already or not, it will be important that each American examines the eligibility guidelines and calculate their very …

Read More »UAE HVAC Market To Surpass $ 2,774.7 Million In Income By 2030, Says P&S Intelligence

NEW YORK, March 25, 2021 / PRNewswire / – One of many principal components within the development of UAE HVAC Market is the fast growth of the journey and tourism sector within the nation. In line with the UAE authorities, in 2017 the journey and tourism sector accounted for nearly …

Read More »Unemployment advantages and money help

Wednesday March 24, 2021 On March 11, 2021, President Joe Biden signed the 2021 US Rescue Plan Act (the “Act”). The legislation is a $ 1.9 trillion financial aid program to combat the COVID-19 pandemic. The Act gives a one-time stimulus cost of $ 1,400 to eligible particular person taxpayers …

Read More »Comcast NBCUniversal to Create Documentary ‘Twenty Pearls;’ The historical past and impression of Alpha Kappa Alpha Sorority, Inc.

Comcast NBCUniversal will current an unique premiere of “Twenty Pearls”, a documentary on the illustrious historical past of Alpha Kappa Alpha Sorority, Inc. Since 1908, the women of Alpha Kappa Alpha reigned supreme, and the world needs to know the way it began. In a documentary instructed about Phylicia Rashād, …

Read More »Alpha-H, Adore Magnificence and others to assist ladies re-enter the workforce

Tina Randello, Business Director of Alpha-H. Supply: supplied Australian skincare model Alpha-H has partnered with 5 different firms to create a “comeback” program to assist extra ladies re-enter the workforce. In its first 12 months, the Encoreship program will provide six full-time paid internships in taking part firms to ladies …

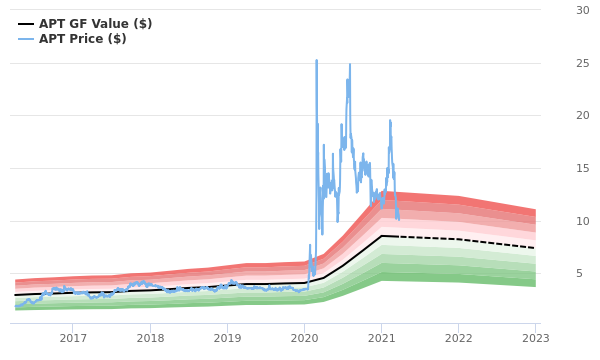

Read More »Alpha Professional Tech Inventory Reveals Each Signal Of Being Modestly Overpriced

– By GF worth Alpha Professional Tech’s inventory (AMEX: APT, 30-year monetary information) is estimated to be barely overvalued, as calculated by GuruFocus Worth. GuruFocus Worth is GuruFocus’s estimate of the truthful worth at which the inventory ought to commerce. It’s calculated primarily based on the historic multiples at which …

Read More »International industrial clothes business to 2027

DUBLIN, March 24, 2021 / PRNewswire / – The “Industrial Wearable Tools Market by Gadget Sort, Part, and Business Vertical: International Alternative Evaluation and Business Forecast, 2020-2027” the report was added to ResearchAndMarkets.com from provide. The worldwide industrial wearable units market dimension is anticipated to achieve $ 8.40 billion by …

Read More »Learn how to play Rocket League Sideswipe alpha check

With the current announcement of Rocket League aspect sweep, a redesigned model of Rocket league which is designed from the bottom up for cell units, Psyonix has already given some players an opportunity to check the sport. Australian and New Zealand gamers obtained entry to a limited-time regional alpha check …

Read More »Beta Nerve Progress Elements Market Anticipated to See Pronounced Progress in 2027 – Normal Cabell

Fort Collins, Colorado: The report, entitled “Beta Nerve Progress Issue Market Dimension by Varieties, Functions, Segmentation and Progress – International Evaluation and Forecast to 2021-2027»First launched the basics of Nerve Progress Issue Beta: Definitions, Classifications, Functions and Market Overview; Product specs; Methodology of manufacturing; Value constructions, uncooked supplies, and so …

Read More »Free Multiplayer Comes To Xbox Alpha Skip-Forward, Extra

In January, Microsoft introduced that it will improve the value of Xbox Reside Gold. It acquired a little bit of a backlash, and Microsoft shortly reversed the change and introduced that it will now not want Xbox Reside Gold to get pleasure from free multiplayer titles. Nicely, it is lastly …

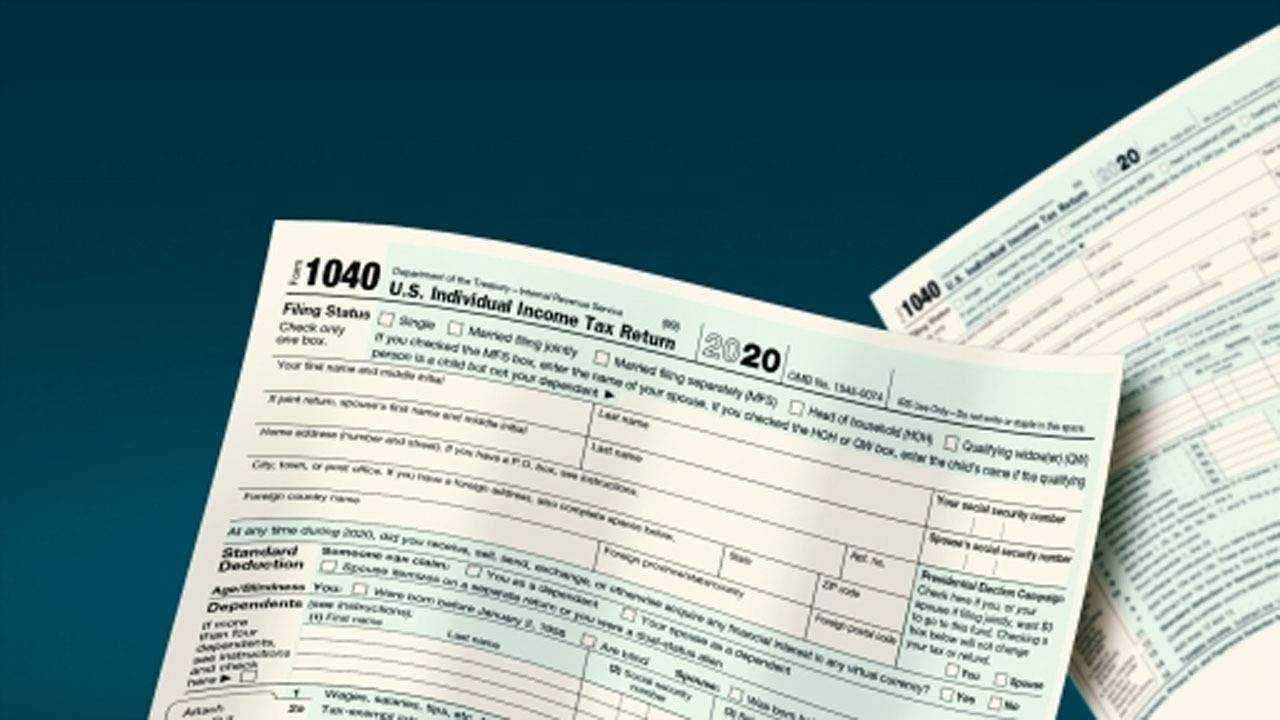

Read More »Anderson: The 411 on dental deductions in 2021

Mark Anderson By Mark Anderson This 12 months, whereas the federal tax deadline has been prolonged, Arizona state taxes nonetheless must be filed by April 15, until you might have filed an extension, by which case they’re. are due October 15, 2021. Both manner, in the event you plan to …

Read More »Alternatives, demand and forecast, 2021-2026

Diclofenac Market Report Overview: Key Improvement Developments, Restraints, CAGR, Compensation Forecast, Product Varieties and Their Scope, Aggressive Floor, COVID-19 Influence Evaluation. The Diclofenac Market report offers an in-depth investigation of this enterprise sphere with emphasis on very important parameters akin to market share, present income, trade dimension, revenue projections, and …

Read More »NT 3 Development Issue Receptor Market Dimension 2021

NT Development Issue Receptor 3 Market Synopsis: – Understanding the affect of COVID-19 on the NT Development Issue Receptor Market 3 with our analysts monitoring the state of affairs world wide. NT Development Issue Receptor Market 3 Evaluation protecting the interval 2021 to 2027. Business protection consists of manufacturing capacities, …

Read More »Florida housing market: extra gross sales, larger median costs in February

by: Marla Martin Florida Realtors Communications Supervisor Amid rising COVID-19 vaccinations and inspiring indicators for the long run, the Florida housing market in February reported extra closed gross sales, larger median costs, extra new gross sales pending and a rise in pending stock in February 2021 in comparison with a …

Read More »Wolf Haldenstein Adler Freeman & Herz LLP Declares Securities Class Motion Filed in United States District Courtroom for the Jap District of New York

The deadline for the principal applicant is April 27, 2021 NEW YORK, March 24, 2021 (GLOBE NEWSWIRE) – Wolf Haldenstein Adler Freeman & Herz LLP declares {that a} federal securities class motion lawsuit has been filed in the USA District Courtroom for the Jap District of New York on behalf …

Read More »Modifications to the well being market subsidy present retroactive help to taxpayers

The retroactive adjustments remove the refund of the early premium tax credit score for the 2020 tax 12 months. Getty One of many unintended penalties of the Supplemental Unemployment Profit (UC) offered as a part of Congress’ Covid-related reduction to taxpayers was that the extra revenue pushed many households over …

Read More »The Ohio Revenue Tax deadline has modified and now matches the IRS deadline of Could 17

COLUMBUS (WCMH) – Ohio has modified its private earnings tax deadline to match the brand new federal deadline of Could 17. Ohio Tax Commissioner Jeff McClain introduced the change on Wednesday. The IRS had prolonged federal deadline final week for private earnings tax. Ohio state taxes can solely be filed …

Read More »New COBRA grant out there April 1, 2021 | Dickinson wright

The American Rescue Plan Act of 2021 (“ARPA”) features a 100% COBRA grant for “individuals eligible for help” in the course of the six-month interval from April 1, 2021 to September 30, 2021. Here’s a abstract of COBRA grant provisions. People eligible for help Those that could also be eligible …

Read More »Union County Faculty: Tuition-free neighborhood faculty out there at Union County Faculty

03/23/2021 CRANFORD – On February 26, 2021, Governor Phil Murphy enacted a tuition-free neighborhood faculty. The New Jersey Group Faculty Alternative Grant (CCOG) supplies final greenback assist to eligible residents to attend neighborhood faculty tuition-free. New Jersey is now one in every of 16 states with applications that make faculty …

Read More »Plastomers Market Dimension 2021-2028 ExxonMobil, Sumitomo, Alpha – KSU

The Plastomers market – World Trade Evaluation, Dimension, Share, Progress, Traits and Forecast, 2021-2027 report supplies plastomers market evaluation for the interval 2021-2028, the place 2020 to 2027 is the forecast interval and 2019 is taken into consideration as a result of the bottom 12 months. The knowledge contained within …

Read More »International Halloumi Cheese Trade Till 2027

DUBLIN, March 24, 2021 / PRNewswire / – The “Halloumi Cheese Market by Sort, Finish Use, and Nature: International Alternative Evaluation and Trade Forecast, 2021-2027” the report was added to ResearchAndMarkets.com from provide. Halloumi cheese is a semi-hard cheese with its coloration various from white to relying on the elements …

Read More »This chart reveals why traders ought to by no means attempt to time the inventory market

At the most effective of instances, it’s tough to time the market, even for probably the most skilled merchants. Immediately, Financial institution of America quantified the magnitude of the missed alternative for traders making an attempt to get out and in on the proper time. Wanting again at knowledge going …

Read More »Low Revenue Power Emergency Assist Apps Obtainable

CHARLESTON, W.Va (WDTV) – The West Virginia Division of Well being and Human Sources (DHHR) has introduced that purposes for the Low Revenue Emergency Power Help Program (ELIEAP) are accepted till Friday April 30 or whereas funds are exhausted. This federally funded program helps eligible state residents pay their residence …

Read More »Bleeding Problems Therapy Market Worth Anticipated to Attain US $ 20.5 Billion by 2027: Acuity Analysis and Session

Acumen Analysis and Consulting, a world supplier of market analysis, in a lately revealed report titled “Bleeding Problems Therapy Market – International Trade Evaluation, Market Measurement, Alternatives and Forecast, 2020-2027″ LOS ANGELES, March 24, 2021 (GLOBE NEWSWIRE) – The International Bleeding Problems Therapy Market is predicted to develop at a …

Read More »Alpha / Echo Company publicizes the summer season launch of I Coronary heart RVing journal

NASHVILLE, Tenn., March 24, 2021 / PRNewswire / – The Alpha / Echo Company (AEA) publicizes the rapid availability of promoting stock and the upcoming summer season launch of I Coronary heart RVing journal. Launched as one of many largest unbiased VR publications on the planet, I Coronary heart RVing …

Read More »Glass packaging market to develop by 12.36 billion USD in 2021-2025 | With Amcor Plc and Ardagh Group SA amongst others

The report provides an in depth evaluation of the affect of the COVID-19 pandemic available on the market below optimistic, possible and pessimistic forecast eventualities. Obtain a FREE pattern report Glass packaging market: growing beverage consumption to drive development. The elevated use of single-serve containers, elevated disposable earnings and improved …

Read More »Deuce Vaughn: the backfield KSU alpha male

MANHATTAN, Kan. –When Kansas State struggled down the house stretch final season, the versatile rusher turned the focus of the offense and remained constant. Deuce Vaughn led the Wildcats in speeding and receiving yards as a real rookie. The Texas native additionally completed No. 1 on the staff in lifts, …

Read More »Latin America Two Wheel Tire Market, Competitors, Forecast and Alternative, 2021-2026 – ResearchAndMarkets.com

DUBLIN – (BUSINESS WIRE)–The “Two-wheel tire market in Latin America, by car kind (bike and scooter / moped), by demand class (OEM substitute or substitute), by area (Brazil, Argentina, Colombia, Chile, Peru, Mexico), competitors, forecasts and alternatives, 2026 “ the report was added to ResearchAndMarkets.com from provide. The 2-wheel tire …

Read More »Luxurious Ties Market Progress Issue and Upcoming Tendencies by 2027 | Hermès, Louis Vuitton, Dior, Gucci, Versace, and many others. – KSU

“This report presents the worldwide Luxurious Ties market measurement (worth, manufacturing and consumption), divides the breakdown (knowledge standing 2015-2020 and forecast to 2026), by main gamers, area, kind and software.” The ‘Luxurious tie market‘ Examine Added by Worldwide Market Studies, offers an in-depth evaluation of the potential components fueling this …

Read More »International Dishwashers Market (2020-2026) – By Product Sort, Software & Distribution Channel – ResearchAndMarkets.com

DUBLIN – (BUSINESS WIRE)–The International Dishwashers Market, By Product Sort (Freestanding Dishwashers, Constructed-In Dishwashers), By Software (Industrial Dishwashers vs Residential Dishwashers), Distribution Channel (Hypermarket / Grocery store, Specialty Shops, others), competitors forecasts and alternatives, 2026 “ the report was added to ResearchAndMarkets.com from provide. The worldwide dishwasher market is predicted …

Read More »International Blood Circulation An infection Testing Market to Generate Income of $ 7,722.2 Million, with CAGR of 8.4% in 2019-2027

New York, USA, March 24, 2021 (GLOBE NEWSWIRE) – In line with a report printed by Analysis Dive, the International Blood Circulation An infection Testing Market ought to generate an revenue of $ 7,722.2 million by 2027, at 8.4% CAGR over the interval 2019-2027. COVID -19 International Blood Circulation An …

Read More »Self-supervised studying to signify time collection –

One of the broadly mentioned machine studying points is time collection forecasting. Time collection forecasting finds essential functions in numerous fields, together with sign communication, local weather, house science, well being, monetary industries and advertising. Deep studying fashions at the moment surpass time collection evaluation with wonderful efficiency in numerous …

Read More »4A Zeolite Market Aggressive Atmosphere and Forecast – 2025 – Cabell Commonplace

International Zeolite 4A Market: Snapshot The environmentally pleasant nature and excessive ion trade capability of zeolite 4A make it a beautiful various to sodium tri polyphosphate (STPP) within the detergent market. Its use presents benefits reminiscent of an excessive sequestering energy at extraordinary temperatures and with out fertilizing impression. Drying, …

Read More »Dynamic Demand, Development, Growth and Challenges of the Paperboard Packaging Equipment Market with Forecast 2030 – Cabell Commonplace

World Bag-in-Field Packaging Equipment Market: Overview The expansion of the worldwide bag-in-box packaging equipment market is attributed to the rising want for sustainable and revolutionary packaging. As well as, it’s estimated that rising consumption of alcoholic drinks in developed and growing international locations will enhance demand for bag-in-box packaging machines …

Read More »How can I borrow money?

Babysitting is a classic among the ways to make money. To earn more money in the future, you must first increase your own value. I myself wanted to know and have tried all kinds of proven pay per click programs, including investing in HYIP funds. However, it pays off …

Read More »Take out an online loan

As a bank and lending company, Good Finance has existed in Germany for a long time. In the meantime, all major banks and credit institutions are present on the Internet and also offer their products online. Even the online credit of Good Finance is no exception. It is one …

Read More »Loss-making cos can now pay non-executive administrators, Auto Information, ET Auto

The trade has requested the federal government for clarification on the proposed definition of wages and complete compensation below the Labor Code on wages and the exclusion of executives from the time beyond regulation clause. Loss-making firms can now compensate their non-executive administrators, together with impartial administrators, as the federal …

Read More »ICRA, Automotive Information, ET Auto

The ICRA estimates that the inhabitants of autos over 15 years of age can be 1.1 million items by fiscal 12 months 2024, providing vital potential for scrapping. New Delhi: The automobile scrapping coverage will enhance auto trade volumes and enhance demand for brand new autos, score company ICRA mentioned …

Read More »Swedish electrical automobile charging firm Cost Amps raises $ 15 million, Auto Information, ET Auto

Cost Amps mentioned it expects gross sales of 250 million crowns this 12 months and has greater than doubled year-over-year development since 2018. STOCKHOLM: Swedish maker of electrical automobile charging options, Cost Amps, mentioned on Friday it had raised 130 million crowns ($ 15.3 million) in a funding spherical led …

Read More »Bag-in-box packaging machine market targets vital progress in 2030 – SoccerNurds

International Bag-in-Field Packaging Equipment Market: Overview The expansion of the worldwide bag-in-box packaging equipment market is attributed to the rising want for sustainable and revolutionary packaging. As well as, it’s estimated that growing consumption of alcoholic drinks in developed and creating international locations will increase demand for bag-in-box packaging machines …

Read More »Oncotarget: Quantitative Proteome Profiling Stratifies Breast Fibroepithelial Lesions

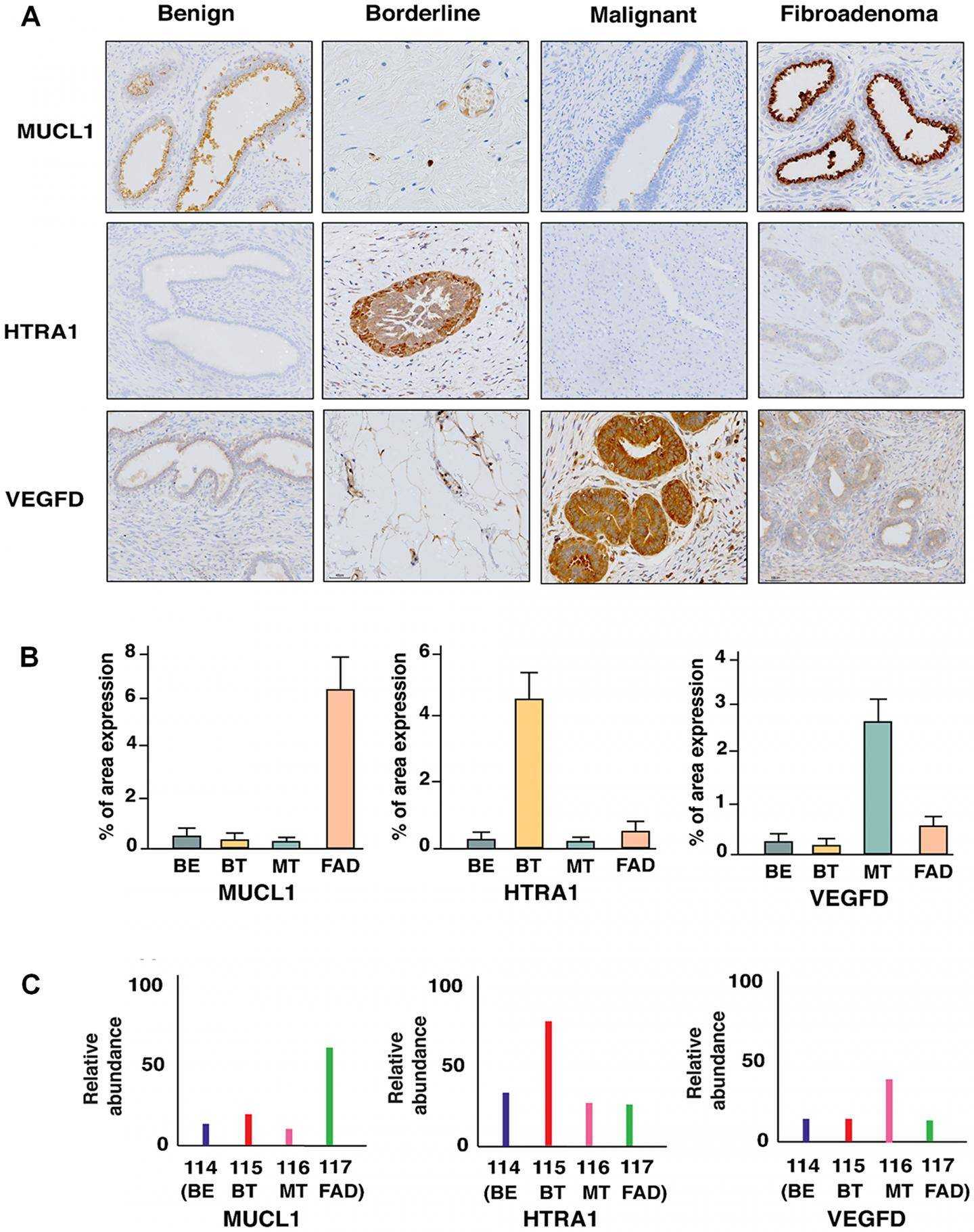

PICTURE: (A) Immunohistochemical staining of MUCL1, HTRA1 and VEGFD that are respectively overexpressed in FAD, BT and MT. (B) Proportion expression of the realm and (C) relative abundance of MUCL1, HTRA1, … see After Credit score: Correspondence to – Lekha Dinesh Kumar – [email protected] and Prashant Kumar – [email protected] Oncotarget …

Read More »Web of Issues Testing Market Developments and Dynamic Demand by 2025 – Normal Cabell

World Web of Issues Testing Market: Snapshot The idea of the Web of Issues (IoT) is regularly beginning to proliferate everywhere in the world. From smartwatches to telephones, from sensible audio system to complete residence assistants, Web issues are quickly to pervade all areas of a person’s life. This presence …

Read More »Evaluation of the potential impression of COVID-19 on the rice flour market – FLA Information

The rising well being considerations amongst individuals and the rising want for a gluten-free food regimen are facilitating the expansion of the flour market. An extreme focus of gluten in meals can pose a critical risk to human well being and might result in anemia, osteoporosis, intestinal injury and long-term …

Read More »The Worldwide Aluminum Institute describes 3 paths for a greener business

Alexander Chudaev / Adobe Inventory The Worldwide Aluminum Institute revealed a report describing how the aluminum business can scale back its emissions. Metallic producers are below growing strain to modernize their manufacturing processes and make them “greener”. In current protection, MetalMiner’s Stuart Burns mentioned China’s newest five-year plan and its …

Read More »U.S. photo voltaic business predicts installations will quadruple by 2030, Power Information, ET EnergyWorld

– Photo voltaic installations in america are anticipated to quadruple by 2030 because of the extension of a key business subsidy late final 12 months and rising demand for carbon-free electrical energy, stated Tuesday an industrial physique. The sector will set up 324 gigawatts (GW) of capability over the subsequent …

Read More »Meet Justin Amash: Congressman from Michigan exploring the presidential candidacy as a libertarian

GRAND RAPIDS, MI – After months of speculation, U.S. Representative Justin Amash, Township of I-Cascade, has made it official: He’s launching a exploratory committee for a third presidential candidacy. Amash, a former Republican turned independent and fierce critic of President Donald Trump, is well known in West Michigan and political …

Read More »WWE 2K Battlegrounds: Undertaker Character Model Revealed

WWE 2K20 Credit: WWE 2K We’re nearing the peak of hype for several sports video game franchises, and the new WWE 2K Battlegrounds series is no exception. Every day, the game’s official Twitter account posts a new screenshot of a roster member. On Monday, it was the Undertaker’s turn to …

Read More »Phoenix Championship Race Odds, Start Time, TV

The favorite to win Sunday’s championship race in Phoenix is not a driver chasing the title. And you can probably guess who this driver is. Kevin Harvick has the best odds of any driver at BetMGM. Harvick, who was knocked out of title contention after finishing 17th in Martinsville, has …

Read More »New York City FC goalkeeper Sean Johnson out for Concacaf Champions League game against Tigers

“We are looking forward to the game,” said Deila. “It was a very strange season, and we trailed 1-0, but we showed in the game the last time we could do something against Tigres. Tigres are a very good team, that also says something about us Tomorrow we’re going to …

Read More »Targa Resources Corp. announces the election of a new Chairman of the Board of Directors

HOUSTON, Jan. 04, 2021 (GLOBE NEWSWIRE) — Targa Resources Corp. (NYSE: TRGP) (“Targa” or the “Company”) today announced that Paul W. Chung has retired from the management team and has been named Chairman of the Board of Directors effective January 1. 2021. Joe Bob Perkins, previously Executive Chairman of the …

Read More »Supply Chain Resilience to Drive Logistics Demand – Commercial Property Executive

Megan Creecy-Herman, Senior Vice President and Head of Western Region Operations, Prologis Resilience, as opposed to efficiency, is emerging as a new goal for supply chain management as global turmoil forces logistics customers to reorganize how they ship goods. Warehouse builders take note, with a framework at the largest industrial …

Read More »India welcomes power-sharing deal between Afghan President Ashraf Ghani and rival Abdullah

NEW DELHI : India on Sunday welcomed a power-sharing deal between Afghan President Ashraf Ghani and his main political rival Abdullah Abdullah that is expected to end months of political crisis in the war-torn country. Tensions had risen after Abdullah, who served as ‘chief executive’ of the Ghani-led Afghan government …

Read More »The sailors had their noses painted by a trident-wielding king with blue hair. here’s why

The “Order of the Blue Nose” has a handful of new members after the sailors of the Roosevelt destroyer Completed the list of King in the North challenges. Ten sailors took part in a unique Navy ceremony this month in which two of their leaders played Boreas Rex, the blue-haired, …

Read More »As Seminole Towne Center struggles, Sanford examines potential for redevelopment

When the Seminole Towne Center opened 25 years ago, the Sanford Mall was one of the hottest malls in the area with high-end department stores Parisians and Burdines as well as Sears and JCPenney, once pillars of the American middle class. The new mall quickly attracted new restaurants and stores …

Read More »CPR Cell Phone Repair expands operations with new store in Tennessee

CPR provides fast and affordable repairs for phones, tablets, laptops and game consoles INDEPENDENCE, OH /ACCESSWIRE/February 6, 2021/ CPR Cell Phone Repair congratulates Loren and Sandra Nunley on the opening of their second franchise store. CPR Savannah joins the industry’s leading network of mobile repair specialists, with over 850 electronic …

Read More »Republic Day 2021: interesting facts about the history and meaning

Republic Day 2021 is fast approaching. This year, India will celebrate its 72nd Republic Day on January 26. Check out some interesting facts related to Indian Republic Day and its significance. New Delhi,UPDATED: Jan 22, 2021 10:33 a.m. IST January 26, 2021 is the 72nd Republic Day of India. By …

Read More »Working together has helped Mount Airy grow

September 11, 2022 Pre-Fall Weather Knowledge With fall less than two weeks away, it’s time to shake up the pre-fall weather lore a bit to speed up the change of seasons. When the hawk is flying high, you can expect Carolina blue skies, but when the hawk is flying low, …

Read More »The story of two dowry deaths in Bangalore

Two women who coincidentally got married on the same day met the same tragic fate. In the first case, a 27-year-old woman who was married four months ago was found hanging from the ceiling of her home in Subramanyanagar on Saturday night. The deceased was identified as Bhuvana and her …

Read More »For Cardinal Becciu, the arrest of Torzi is not an “earthquake”

On November 4, 2019, CNA reported that in 2015, Cardinal Becciu appears to have attempted to conceal on Vatican balance sheets nearly $200 million in loans related to the transaction by writing them off against the value of the property in London, a prohibited accounting maneuver. by the financial policies …

Read More »Are Side Hustles here to stay in a post-pandemic world?

At the start of 2020, most people I knew were scrambling to destroy their student loan going into debt, increasing their retirement savings, or quitting a job they hate. But as the pandemic pushed the unemployment rate to an all-time high, more Americans have turned to side hustles to survive. …

Read More »Superman and Lois Cast on Who Makes Their Superhero Dream Team Cut

| The CWs Tyler Hoechlin and Elizabeth Tulloch– featuring Superman and Lois is ready to fight for truth, justice and as many viewers as possible (same day or delayed) when it kicks off its two-hour premiere event on Tuesday, February 23 (90-minute premiere followed by the special Superman & Lois: …

Read More »We think Adveritas (ASX:AV1) needs to drive its business growth cautiously

We can easily understand why investors are attracted to unprofitable companies. For example, although Amazon.com posted losses for many years after it listed, if you had bought and held the stock since 1999, you would have made a fortune. That said, unprofitable businesses are risky because they could potentially burn …

Read More »Morley is filling full-time customer service jobs with same-day deals on Tuesday, February 11

SAGINAW TWP, MI – Morley Companies is hosting a recruiting event on Tuesday, February 11 to fill full-time customer service positions. The event is due to take place from 9 a.m. to 3 p.m. at Morley, 4075 Bay Road, and recruiters are aiming to make offers the same day. “Don’t …

Read More »Singapore to lay the groundwork for a regional carbon credit market

Ravi Menon said there was a need for more high-quality carbon credits and more trading of those credits across borders to drive convergence towards a global carbon price. An Asian carbon credit market must be part of the strategy to achieve both development and sustainability in the region, Chief Executive …

Read More »National Student Loans Service Center plagued by delays as aid requests soar

Crowds of former students have been unable to reach the Canada Loans Centre, which is processing a backlog of more than 30,000 applications for repayment assistance. The National Student Loans Service Center’s phone lines have been clogged since the lifting in late September of a pandemic-induced moratorium on student loan …

Read More »Three alternative options as Manchester United captain

The fallout from the Harry Maguire saga in Greece is still playing out. Sky Sports report Maguire was given a suspended sentence by the Greek courts, which he made clear he intended to appeal. Maguire was called up to the England squad on the same day and is expected to …

Read More »The Reverend apologizes after calling Captain Tom Moore a ‘cult of white British nationalism’

A Church of England a cleric apologized after describing the national applause for Captain Tom Moore as emblematic of a “cult of white British nationalism”. In a since-deleted tweet, Reverend Jarel Robinson-Brown wrote: “The cult of Captain Tom Moore is a cult of white British nationalism. I will offer prayers …

Read More »Brex Offers FDIC Insurance | PYMNTS.com

Brexitthe financial technology startup from San Francisco, offers FDIC insurance on its cash management account at no cost, the company announcement Wednesday (July 22). The new Brex Cash feature allows customers to choose to hold cash savings with FDIC insurance or invest in money market funds. “Brex Cash gives its …

Read More »Ann Arbor council hopefuls to participate in virtual candidate forums

ANN ARBOR, MI — As coronavirus outbreak continues, candidates for Ann Arbor City Council are expected to participate in a pair of virtual candidate forums. University of Michigan students in former Mayor John Hieftje’s classes at the Ford School of Public Policy have held a candidates’ forum in the spring …

Read More »Hackensack firefighter dies of 9/11 cancer; death will be ‘on duty’, officials say

A longtime Hackensack firefighter died Saturday morning of cancer contracted while assisting other firefighters at Ground Zero after the September 11 attacks, friends, family and firefighters said. Early Saturday morning, Rich Kubler, 53, died of stage 4 liver cancer he contracted after responding to the September 11 attacks, the Hackensack …

Read More » Resource KT

Resource KT

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/XEEODNVWBFGGDNHTYWUKV4GMIE.jpg)