Following its inaugural social bond issue, Rhode Island Housing and Mortgage Corp. plans to issue $82 million of multifamily development bonds on Wednesday.

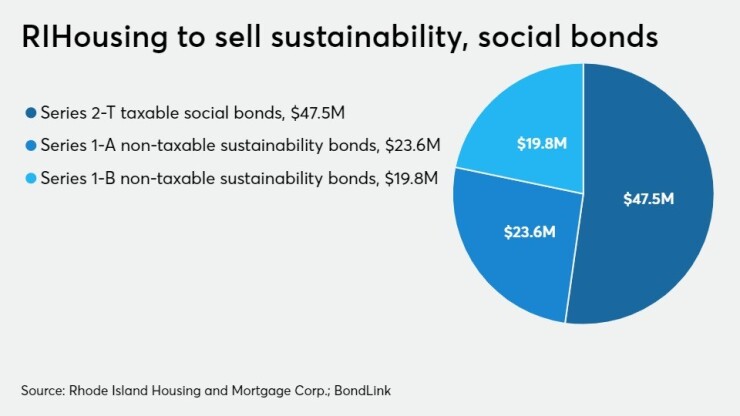

RIHousing’s negotiated sale, which will include a same-day retail component, includes $47.5 million in federally taxable Series 2-T social bonds, $23.7 million in exempt sustainability bonds 1-A series; and $10.8 million of Series 1-B Exempt Sustainability Bonds.

JP Morgan Securities is the lead manager.

RIAccommodation

In September, RIHousing issued $142 million in Social Bonds or Homeownership Opportunity Bonds. The proceeds funded affordable home loans and down payment assistance for low-to-moderate income first-time home buyers in Rhode Island.

Social bonds raise funds for new and existing projects that address or alleviate a specific social problem and/or seek to achieve positive social outcomes. Their designation reflects the use of bond proceeds in a manner consistent with the principles of the International Capital Markets Association and the United Nations Sustainable Development Goals.

“What we’re doing with our first-time buyers really aligns with the principles of social connection that are out there,” CFO Kara Lachapelle said. “Home ownership is a generator of wealth for some people.

The Rhode Island Legislature established RIHousing in 1973 to provide funding for affordable housing for low-to-moderate income families. Being in the smallest state in the country has its advantages, according to Lachapelle.

“You can drive across the state in about an hour,” she said.

In addition to its bond programs, RIHousing administers the Section 8 Housing Assistance Program, Real Estate Investment Partnership Program, and Federal Low-Income Housing Tax Credit, as well as other federal and state programs.

RIHousing has also launched an investor relations website powered by Boston-based technology company BondLink.

“Transparency is so important these days,” Lachapelle said.

The agency has about $1.2 billion in bonds outstanding, with little floating rate debt.

Moody’s Investors Service has rated RIHousing’s outstanding parity bonds and all debt Aa2, with a stable outlook.

Moody’s cited the program’s strong financial position and the large proportion of Federal Housing Administration risk-sharing insurance in the portfolio, which offsets the risk of uninsured loans and second-lien loans within the program.

“Housing finance agencies have been around for quite a long time,” Lachapelle said. “For RIHousing, our focus is on the longevity of the agency and the bond program.”

Like many housing agencies nationwide, RIHousing adjusted on the fly as the COVID-19 crisis escalated. “We felt we did a really good job of adapting to the pandemic,” Lachapelle said. Outreach, she said, included online courses, tutorials and video presentations.

The closing date is January 27. Hawkins Delafield & Wood LLP is a bond advisor. Locke Lord LLP is the special counsel and Kutak Rock LLP represents the underwriters.

Resource KT

Resource KT