Natalia Lagutkina/iStock via Getty Images

After many years of heavy investment (~$8 billion invested in building world-class LNG infrastructure around the world in the past 8 years or so), New Fortress Energy (NFE) has begun to reap the benefits . In particular, all eyes are on cash flow generation, as this has been ENF’s weak spot so far. The main reason is that it takes a little time (years) to develop assets (permitting, construction, etc.) until they are operational (with all the security measures in place) and reach the way of generating income.

NFE cash flow statement Looking for Alpha

As you can see from the cash flow statement above, operating cash flow has been consistently negative for the past several years. In other words, the company was burning cash in its operating activities, and on top of that the company had to manage an investment program of around $8 billion, including raising capital. As a value investor, I tend to avoid negative operating cash flow situations. However, the good news is that from 2022 we have entered the era of negative operating cash flow. But there is even better news. Operating cash flow will not only be positive, it will be significantly positive in fiscal year 2022. And the situation improves further in fiscal year 2023 and beyond, given the nature of NFE contracts, with conservative exposure to commodity risk. In other words, NFE turns into a nice cash flow machine, allowing for a big cumulative effect, and that’s what I’m looking for as a value investor.

Below, we’ll detail how NFE’s operating margin will translate to free cash flow going forward. Management has guided the following:

- For fiscal year 2022, NFE is on track for an operating margin of at least $1.1 billion.

- For fiscal year 2023, NFE is on track for an operating margin of at least $1.5 billion

As a reminder, the operating margin figures do not take into account general and administrative expenses (sales, general and administrative), interest and taxes, as well as debt amortization payments (not an expense in itself but a cash outflow nonetheless).

Let’s take an operating margin figure of $1.5 billion. From this subtraction:

- $100 million for general and administrative expenses

- $300-400 million for interest and amortization payments

So we’re left with just over $1 billion (pre-tax) of free cash flow per year. It is important to note that NFE will continue its credit enhancement initiatives and pursue a quality rating (note that S&P recently upgraded NFE’s issuer credit rating to ‘BB-‘/Stable outlook from ‘ B+”), which can free up more than $200 million in annual cash flow. by simplifying and refinancing the capital structure. During the third quarter 20201 earnings call, NFE CFO Christopher Guinta breaks down the $200 million cash flow “savings” as follows:

We expect to be able to refinance our $2.75 billion of high yield notes at rates approximately 300 basis points lower than current borrowings and reduce interest expense by approximately $80 million per year.

Additionally, over time, we can refinance $1 billion of asset-level debt, removing more than $120 million annual amortization. Unleashing these additional cash flows is the next key step in maximizing our cash flow available for reinvestment or for dividends. With that, I’m forwarding the call to Wes.

These are all steps in the right direction of leveraging credit rating improvements to lower the cost of capital and removing annual amortization requirements to maximize flexibility and investing in opportunities for higher returns when they arise.

Additionally, assuming $200 million in taxes (net income will be taxed at varying rates across the business), NFE can generate at least $1 billion in free cash flow per year, after-tax payments. In other words, $1 billion of cash will accumulate on the balance sheet each year. If this base case scenario were to materialize (I see no reason not to), it would provide a huge option “for reinvestment or for dividends”, as the CFO mentioned.

Anyway, with $1 billion in high quality free cash flow per year and a current market cap of around $4.2 billion, NFE seems to be very cheap right now with a yield of pro forma free cash flow of approximately 25%. Also, we’re just getting started in terms of free cash flow growth, as LNG is a booming business, as is hydrogen (more on that below). Add to the mix the additional value and additional cash flow that will be created by reinvesting a portion of the $1 billion annual free cash flow, NFE’s stock price could well rise more than 4x from the current levels at $80+ per share, and still be reasonably valued.

Interestingly, I came across a presentation from NFE’s 2021 Annual Investor Update dated July 21, 2021, and slide 50 is particularly interesting, which provides analysis in support of a benchmark valuation of ~$82 to $120 per share.

Base Case Assessment New Fortress Energy

I agree with this thought process and we are off to a promising start. Last year, as well as so far this year, NFE’s stock price has unfortunately experienced abysmal performance. It seems to me that NFE is lumped in with alternative fuel stocks such as Bloom Energy (BE), Ballard Power Systems (BLDP) and Plug Power (PLUG).

The strong correlation is clear. Even though NFE has created a promising and growing division called ZERO, which aims to provide carbon-free energy by replacing fossil fuels with affordable zero-emission hydrogen, NFE is primarily an LNG company, at least for the moment. It looks like market players aren’t really doing their homework, which has created a great buying opportunity. Of course, NFE will continue to progress through its subsidiary Zero Parks to advance the energy transition by investing in blue and green hydrogen, and, moreover, it is about to launch its first project in the USA.

US Gulf Coast NFE Hydrogen Project New Fortress Energy

NFE plans to acquire a key site on the US Gulf Coast with key design and contracts expected in Q1 2022. In other words, very soon. Importantly, NFE expects to be able to finance the lion’s share of capital requirements with tax-exempt financing (i.e. high leverage at low interest rates).

While I’m really excited about the US Gulf Coast project and NFE’s hydrogen aspirations, I want to point out that from the operating margin of over $1.5 billion, which will eventually translate to approximately $1 billion in free cash flow per year (as shown above), pretty much it all has to do with LNG. In other words, hydrogen and ammonia are future initiatives that will complement NFE’s LNG infrastructure and ultimately generate substantial cash flow, but we are still (years) away from that point. As such, the market got it completely wrong, at least associating NFE with negative cash flow producing companies that capitalized on the green hype. NFE approaches green initiatives in a sensible and conservative manner, benefiting from the backbone of strong cash flow from the core LNG business.

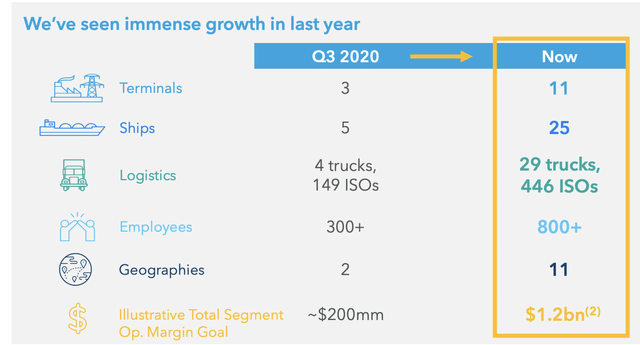

In conclusion, NFE has reached a significant inflection point by generating substantial free cash flow. This will be reflected in the financial statements of the next quarters. However, investors who have not done a thorough pro forma analysis on NFE and who rely heavily on filters (which by default have lagged data) will incorrectly assume that NFE is burning money and has high debt leverage. In fact, with over $1 billion in operating margin, NFE targets 3x leverage coverage ratios. Also, it seems that many investors mistakenly group NFE with several Green Revolution companies that are losing money right now. While NFE has a bright green future ahead of it, it also has a bright future generating strong free cash flow from its growth of the LNG activity. In the past, a valid risk was the concentration of NFE. But this is no longer the case. NFE has diversified its cash flows, which include volumetric gas and electricity revenues, capacity payments, freight sales, shipping, etc. In fact, in Q3 2020, NFE had 3 terminals, 37 customers in 2 geographies/markets. Today, NFE has 11 terminals, more than 100 customers in 11 different geographies/markets. This massive shift in the diverse footprint of NFE’s business is reflected in the following table.

NFE Diversification Initiatives New Fortress Energy

This balanced and diversified growth is the main reason S&P upgraded NFE’s credit rating. Things are going in the right direction on all fronts except for the stock price, hence the buying opportunity.

Resource KT

Resource KT