Denise Hasse/iStock via Getty Images

Despite a prolific downturn in the Chinese economy due to covid shutdowns, the price of copper has remained stubbornly high. Freeport-McMoRan (NYSE: FCX) fell dramatically last month, but high copper prices are a very positive sign for the copper miner. My investment thesis remains very bullish on the stock due to strong copper demand and weak supply growth.

Stubbornly high copper prices

Freeport-McMoRan fell from a high near $52 to a low of $35 in early May on perceived weakness in copper prices and demand. The key here is that any weakness in China will eventually be compensated for when the country fully reopens and clean energy is expected to absorb all free supplies over the next decade.

Copper prices have fallen alongside recent market weakness, but a quick look at the 5-year chart will help alleviate fears about the impacts of the copper miner’s finances. Copper prices are still above $4.32/lb and near yearly highs.

Source: Kitco

Only a year ago, Freeport-McMoRan didn’t even quote cash flow and EBITDA targets based on copper prices above $4/lb. Now, even in an extended period where recession fears are rampant and the main copper consumer market has been closed, copper prices have held above the key price threshold.

Copper supplies continue to head into a major shortfall going forward. Rystad Energy has projected a 6 million ton copper supply shortfall by 2023. What’s crazy about this forecast is that the supply shortfall will be as much reduced compared to a 12% decline in supplies by 2030, as existing mines face declining reserves and ore quality.

Source: Rystad Energy

In addition, geopolitical issues remain a major issue for copper. Peru continues to push for higher taxes on miners, while Chile has a new government that has proposed a major mining overhaul. In addition, Russia accounts for about 4% of copper production and the war in Ukraine puts these supplies at risk.

Another main reason for an undersupplied copper market in the coming decade is the conversion to electric vehicles. Each BEV uses about 183 pounds of copper, while some conventional cars only use 18 pounds.

Source: Copper Development Association

Each million electric vehicles uses about 150 million pounds. extra copper. As China produced 3.3 million electric vehicles last year and Europe bought 2.3 million, the market can quickly see the amount of additional copper needed to fuel the growing demand for electric vehicles. Remember that these figures are for vehicle production only, the amounts do not include the additional copper needed for charging networks and power delivery.

Structural advantages

Despite the higher prices and signs that copper prices are expected to remain high, Freeport-McMoRan has a current mine plan where production begins to decline in 2024. The copper miner predicts that copper production in 2024 will drop to 4, 2 billion pounds compared to the peak of 4.45 billion pounds in 2023.

Source: Freeport-McMoRan Q1’22 presentation

The company has only forecast a net unit cash cost of $1.44/lb, so profit margins remain very strong at much lower copper prices. Past copper price volatility and the time required to develop new mines make aggressive spending less desirable.

The planned Kucing Liar mine in Indonesia has the capacity to produce around 600 million pounds of copper and 500,000 ounces of gold per year, but Freeport-McMoRan estimates a development timeframe of 10 years. The whole electric vehicle revolution will have happened by the time this mine reaches production.

Freeport-McMoRan is expected to remain a slot for the next decade. Copper’s ability to hold prices near $4.25/lb in this environment suggests that copper prices may test the $5/lb levels. The copper miner has very impressive finances as the price of copper rises due to mostly fixed production costs.

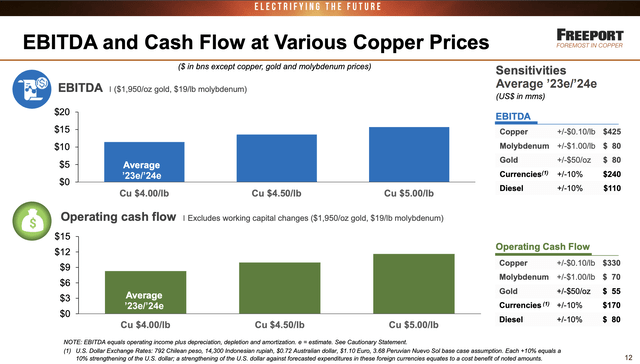

The company could approach $15 billion in annual EBITDA and cash flow from operations approaching $12 billion at $5/lb. After all, every additional $0.10 of copper price adds $330 million to operating cash flow. The difference between $4.30/lb and $5.00/lb represents $2.3 billion in additional operating cash flow.

Source: Freeport-McMoRan Q1’22 presentation

The stock now only has a market capitalization of $55 billion. Without debt, Freeport-McMoRan is trading below 4 times its adjusted EBITDA targets of $5/lb.

The stock is so cheap that Freeport-McMoRan can continue to use the large free cash flow to buy back stock. The company has a capital repayment plan aimed at returning 50% of cash flow to shareholders.

Carry

The key investor takeaway is that Freeport-McMoRan is incredibly cheap, while the company doesn’t have the debt issues of past cycles. The biggest risk for the stock is a major recession that leads to the abandonment of a large number of electric vehicle projects, while the blockages in China continue to dampen demand for copper.

The stock is simply too cheap for the risk/reward scenario, with the copper miner trading at such a low EBITDA multiple.

Resource KT

Resource KT