MoMo Productions

Compared to many other fintech companies, Fiserv, Inc. (NASDAQ: FISV) has held up quite well, down just 10% in the past year. FISV is a great example of a “GARP” (growth at a reasonable price) business that can do well in this uncertain environment. As its legacy payment processing business faces competitive threats, it is on the attack with new products that challenge new entrants like Block (SQ) and PayPal (PYPL). I think stocks can get back into the $110-115 zone, which is up to 20% upside.

Looking for Alpha

In the company’s second quarter, we see strong results as the company’s acquisition of First Data went smoothly with synergies of $600 million realized well ahead of schedule. Second quarter revenue increased 10% to $4.2 billion, with organic growth of 12%. As a result, Adjusted EPS rose 14% to $1.56. A point of caution is that operating margins of 33.5% were down 40 basis points year over year. Although FISV has several key growth initiatives, these may prove to be slightly lower margin than its historical business.

Fiserv is basically a payment processing company. Its technology platforms enable companies to accept transactions and move money between banks, customers and businesses. It operates in three main segments. The first and most important is commerce, where the FISV enables large and small businesses to transact, with a particular focus on e-commerce and digital transactions.

Merchant revenue grew 14% to $1.9 billion, representing nearly half of the company’s total. Volume growth was 7%, while transaction growth was 5%, a strong result considering that Fidelity National Information Services, Inc. (FIS) experienced a sequential volume decline of 5 %. There are fears that traditional merchant payment networks could be disrupted by Square’s Cash app, PayPal, or even longer-term threats from decentralized finance providers or something blockchain-related. Fortunately, there was a hidden gem in Fiserv’s purchase of First Data in 2019, an app called Clover, a point-of-sale system for small and medium-sized businesses.

The growth was huge and increased 24% year-over-year in the second quarter, reaching an annualized gross payment volume of $233 billion. By comparison, PayPal’s payment volumes exceed $1.2 trillion per year. Although Clover is now a large-scale company, there is still significant growth potential. Fiserv launched Carat, a Clover lookalike, to target large businesses, and found that pairing Clover with other offerings it has — like Bento for restaurants — can lead to greater usage and up to triple revenue.

Essentially, there is a high-growth fintech disruptor inside a well-established fintech player. With the breadth of its existing relationships, Fiserv was able to deploy Clover quickly and drive substantial growth. Today, Fiserv has a market capitalization of $63 billion. Even after losing two-thirds of its value, PayPal is worth nearly $100 billion. At around 20% size, Clover could be a $20 billion asset that isn’t fully reflected in FISV’s valuation, creating room for upside as it becomes a larger part of the company.

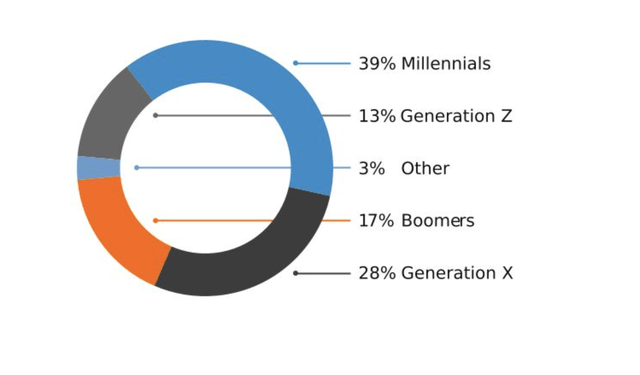

But Fiserv isn’t just disrupting merchant volumes, it’s also disrupting payments. In the second quarter, it delivered 7% revenue growth in its payments and networks group to $1.5 billion. Operating margins were down 80 basis points as increased competition in payments is definitely putting pressure on pricing. However, Fiserv isn’t just letting its core business compete, it’s leading the way as a key processor under the Zelle platform. For those unfamiliar, Zelle is owned by a consortium of major banks to enable person-to-person money transfers. It’s basically their answer to Venmo. As you can see, its users are generally younger Americans, with millennials being the largest cohort.

Fiserv

This should position the platform for continued growth, and Fiserv is a major beneficiary. It recorded a 35% growth in its Zelle business. This still represents only 2% of its payment business, but it is growing rapidly. Last quarter, it surpassed 1,000 Zelle customers, with hopes of doubling that number in two years. The network effect is expected to allow revenue growth to outpace customer growth, and by 2025 this could be 8-10% of business and growing. Even as the nature of financial transactions changes, Fiserv is positioning itself to be an integral part of the financial system of tomorrow, with key and growing offerings on business-to-consumer and consumer-to-consumer transactions.

As you can see, this led to the company raising its full-year guidance on the revenue front and raising the bottom of its EPS guidance. As mentioned, these new offers and increased competition weighed on operating margins, which will increase less than expected. Still, it’s better to sacrifice margins to position yourself for long-term growth than to try to preserve them but risk falling behind other fintech peers. I’d also like to note that this forecast assumes 200 basis point currency headwinds going forward, worse than last quarter’s -150 basis point performance given continued dollar strength. When the company releases its third quarter results on October 27, I see some risky currencies being a slightly bigger drag.

Fiserv

Fiserv also revised down its free cash flow conversion, with its second-quarter conversion down just 65% to $658 million. Part of that is due to working capital, which has been a headwind of $463 million year-to-date. Holding working capital constant, free cash flow would have been approximately $1.55 billion in the first half. The other reason is that its cap-ex spend has jumped from $500 million to over $700 million since the start of the year. I see this as positive, as FISV’s investments in Clover, Carat and Zelle are generating significant growth and helping to sustain the business. Sacrificing some cash today to accelerate these investments and expand their infrastructure is a prudent long-term decision.

Additionally, the company is still on track to generate approximately $3.5 billion in free cash flow this year. This allows for regular share buybacks, including $500 million last quarter. It has now fallen to 651 million shares outstanding, down 3.3% year-on-year. It should be able to continue to reduce its number of shares at 3-5% per year, even with this faster rate of cap-ex.

My only negative point is that the company has $21.5 billion in debt incurred to acquire First Data. $4.8 billion of this amount matures over the next two years, and $3.4 billion is floating rate. Management is directing cash flow primarily toward buybacks rather than debt reduction. Thus, given the rise in interest rates, its interest expense could increase by $125 million to $175 million, or about $0.25 per share. It’s a manageable headwind but a headwind nonetheless.

Fiserv offers a unique blend of a highly cash-generating business from its heritage as an entrenched player in the plumbing of the financial system, along with the advantage of growing new products that could become essential to the financial system of the future. This gives him the capital to buy back shares and invest in growth initiatives. Even with currency headwinds and slowing legacy volume growth in a declining economy, as management begins to discuss the outlook for 2023, it should be at least high single digits as Clover and, in a lesser extent, Zelle, stimulate growth.

With around $7 in future earnings power, the stock only trades at 13.5x, which is attractive given the undervalued growth companies it’s building. I think the company deserves a multiple closer to the broader market, given its quality and growth attributes, or at least 16x, indicating a fair value of around $113, which gives the stock a 20% upside %. For investors looking for a cash flow generating company with the potential to grow at a reasonable multiple, Fiserv is a great opportunity.

Resource KT

Resource KT